March 2026

The weekend that heralded the start of March 2026 was headlined by the bombing of Iran and their retaliation and at the time of writing the start of this blog, the ramifications are ongoing and time will tell what will happen in the next few days and weeks.

Understandably, oil prices rose promptly (again at the time of writing) and some equity markets opened marginally lower. Gold prices were slightly lower at the end of 02 March 2026.

The next Spring Statement is planned for 03 March, and the UK political situation seems far from certain as I write, therefore we may see plans change.

There no longer seems to be a time of the year within the financial advice area that is not busy, with many spreading their attention to their personal finances over the year, rather than waiting for a deadline to rapidly appear on the horizon. Summer 2026 will see the football World Cup in North America unfold over the months of June and July and for some, this might be a distraction (and for others of limited interest, although I am sure that there will be other events that might suit).

The effects of the Budget announcements from the end of November 2025 are now known and this allows many to plan ahead as we all face a higher tax regime over the coming years. The Spring Statement date has been announced for 03 March 2026.

There is much to consider globally, not least with the very recent events in the Middle East. As observations, some global areas (America / Germany / Japan as examples) are deliberately ‘running hot’ on their economies which in turn is fuelling some equity markets and we do not expect these positions to change in the near term although, as noted above, there are no guarantees. Russia and Ukraine are still firmly in the news having reached well into the third year of hostilities, and with what appears to be the stalling of negotiations to bring the conflict to an end. Increased spending on (national and collective) defence has been agreed over the next years, and it almost has a feel of returning to the ‘cold war’ of decades ago.

Changing of debt parameters

The objective of the now not so new Chancellor is to effectively redefine the way the UK's debt rules work going forward. The planned effect is to allow the Chancellor to borrow more money for the next five years. We are talking about up to £50bn extra to help pay for the planned spending ahead, such as infrastructure spending. The risk is that interest rates remain higher than expected, costing us more over time. Subsequently, borrowing costs have elevated further and have not deviated downwards, putting more cost and pressure on the UK's already squeezed budgets.

More can be found on our late 2024 blog here: 30-october-2024-budget-the-headline-changes

Economic data from home and abroad

Mid-February 2026 saw the Office for National Statistics (ONS) confirm that the Consumer Prices Index (CPI) decreased to 3.0% (from 3.4%) in the year to January 2026. This reduction from December was mainly due to lower petrol costs along with reductions in bread & cereal, amongst other items. The Bank of England target for UK inflation remains unchanged at 2.0%, and inflation is remaining above this level.

As a note, US inflation has increased slightly - consumer prices (before seasonal adjustment) increased to 2.7% over the 12 months to December 2025. However, the continued and new applications of tariffs have seen some predict that US inflation will rise again.

The Bank of England cut its base interest rate to 3.75% in December 2025, the lowest level since early 20232023 and held this position in early February 2025, although it was a tight vote by the Monetary Policy Committee. In the final rate decision of 2025, the US Federal Reserve reduced the base rate to a range of 3.50-3.75% in December 2025, the lowest for three years. The Federal Reserve has indicated that this position may be held for a while looking forward.

It should be noted that higher interest rates are good news for savers, and some savings accounts are offering 4.0% - 4.25% pa gross plus. Look out for the AER rate pa (Annual Equivalent Rate) which show the real rate of interest being provided. Of course, higher interest rates are not so good for variable rate borrowers, and the days of cheap borrowing for individuals and nations are over, certainly in the shorter term.

As you might anticipate, many financial thoughts will be UK focused; however, the world is now a small place and many of these economic factors are occurring globally, as we enter a new era of higher costs, inflation, interest rates and the like. Increasing numbers of global conflicts remain constant at this time, along with new threats of US tariffs.

We have looked at some of these points below.

GBP / US dollar

Many readers will know that exchange rates can vary for many economic reasons. For some, it may only become apparent when purchasing foreign currency for a holiday or visit abroad. The current indicated exchange rate is $1.34 at the time of writing (02 March 2026), still an elevated rate in recent times.

UK Net Public Sector Gross Domestic Debt v GDP

It is noteworthy that net public sector debt has consistently run for some time at approximately 94%-100% of UK monthly GDP (gross domestic product) (source: Office for National Statistics / ONS). The January 2026 saw a reduction, with the statistics showing the provisional estimate as 92.9% and remains at levels last seen in the early 1960s. Some will not want to see this level (and its associated interest costs) rise, and welcome this recent reduction.

The ONS notes that GDP growth in the UK to December 2025 for the prior three months was 0.1%, with 0.1% growth in the prior quarter. Many global trading areas saw their short-term growth forecasts reduced by the OECD (Organisation for Economic Co-operation and Development) in early June for 2025 and 2026 because of the recent tariff / trade wars.

Markets factor in most things

Turning to the recent market position, many individuals may refer to the value of their pension or ISA arrangements as a reference point to how markets are moving. We all know that the value of funds can fall as well as rise, and we have seen some volatility this year, although alongside positive returns from some global equity markets. Volatility is not uncommon, and this can be triggered by global economic events, or their continued effects.

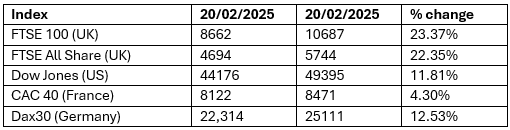

The key point here is that if we think something is happening (such as the ongoing cost-of-living issues and rising tax costs), the markets have usually factored in the effects. Looking at the markets on 20 February 2026, in comparison to a year ago, we find the following (approximate) for a range of market indices:

Market values can fall as well as rise and this is only a snapshot in time. As you can see, and as anticipated, some markets in this snapshot have performed better than others, although this is not a guarantee of future performance.

The tax year 2025/2026 is nearly over and there is much to consider

The end of the tax year is now in sight (and as noted with Easter spanning the change in tax years), there is still time to use your tax allowances if not used elsewhere, and where appropriate and affordable.

We look forward to helping you with your financial planning.

Keith Churchouse FPFS

Director

CFP Chartered FCSI

Chartered Financial Planner

Chapters Financial Limited is authorised and regulated by the Financial Conduct Authority, number 402899